The TUC Digital Lab held a webinar on how unions can run the most effective online campaigns to switch members from check off dues deduction to paying via direct debit.

We looked into what would make a switching campaign more effective, in terms of tech, process and communications.

The context

The government have laid secondary legislation to implement some of the remaining parts of the 2016 Trade Union Act that they were unable to bring in earlier. This is called the “Trade union (deduction of union subscriptions from wages in the public sector) regulations”.

The new regulations specify that a relevant public sector employer can only operate a check off scheme for a union if two conditions are met: that the union must pay the employer a “reasonable amount” for the cost of administering it; and that the union must offer members an alternative means by which to pay their subscription if desired. If either of these conditions are not met. then the public sector employer will have the right to remove check off.

The scope here is all public sector employers in England and Scotland, including any arm’s length bodies. Any existing check off agreements that are in scope, but which don’t currently involve a fee that the government would define as reasonable, will need to be renegotiated.

There are many shortcomings in the clarity of the regulations, as well as the intent, which the TUC and unions are currently challenging. It’s also possibly open to challenges in terms of lack of consultation and inadequacy of the six month implementation period.

But given the current time frame for the regulations coming into force is 9 May, many unions may want to switch remaining check off members to direct debit payment, to save being impacted by the changes.

Switching members at PCS

PCS have already transitioned all members at the majority of their public sector employers over to direct debit, following attempts by some government departments in 2015 to unilaterally end check off. Head of Digital Organising Julie Young gave us a case study of what they did and learned from this work.

The first part of their campaign to switch members was an extensive mapping exercise to ensure PCS had as much up-to-date contact details for members as possible, and knew where members were. This allowed the creation of lists of members that could be marked off once they’d switched, so the union knew they didn’t have to go back and speak to them again.

Second, the union trained reps and staff on how to answer objections from members, before any of the process began. PCS knew there would be members who didn’t want to switch for a variety of reasons, or whose banking arrangements meant this would be hard for them.

A FAQ list was produced, covering the reasons for the switchover, and the process of how members would do it. This meant identifying and answering things like supporting members whose banks didn’t offer direct debits, those who were on debt management plans, and those who didn’t want their partners to know that there were members of the union.

There was a degree of frustration towards the union for upsetting a mechanism that many members had been using for years without complaint. The FAQs had to have a compelling answer that the inconvenience was the fault of the government, who were cynically trying to damage and weaken the union in their workplace. When members realised this, it translated into a lot of energy to fight back by doing their part in switching.

When the materials were ready, PCS had to systematically approach every single member and re-sign them up to the union.

In some areas, the union found the employers were happy to help and encourage workers to engage with the union in this process. Others were more hostile and so the work had to happen without using their facilities to speak to members.

It was an all-hands-on-deck approach, with all staff, all reps and all interested members taking part. One by product of the campaign was starting PCS’ Advocate Program – a way to provide members with new ways to get active and take part in the work of reps, without needing to become a full rep themselves. Giving them manageable tasks to do has helped a lot of those advocates to get more involved in the union since.

A communication plan ran alongside the work on the ground. Bulk emails to members were used, as well as blogs and videos, including a video message from the General Secretary. There were incentives as well, like a prize draw for switching members to win an iPad, which was very popular with members.

In terms of lessons, the first was that the union needed as many people on the ground as possible. This meant sending staff to workplaces to support reps and advocates there. Face to face contact was really important in explaining to members why they were doing this.

Secondly, despite PCS’ best efforts they still lost some members in the switch over. Unions need to be prepared to lose members through the gaps in the system when going through this process, and that’s the government’s aim in doing it.

But one advantage is that the union is more clearly independent of the employer. Employers now no longer know the detail of how much power PCS have in the workplace, who is and isn’t a member. And they can no longer hold the threat of withdrawing check-off over the union.

As this was before the union’s move to a modern platform CRM system, it required a lot of paper lists, and paper sign up forms for the new direct debits. The union had to ensure all staff and activists had locked cabinets available to store this sensitive member data, and even then members had security concerns about writing their bank details on sheets of paper.

For any future campaigns, the union’s digital solution takes most of that concern away, and also smooths the process considerably with forms for members to switch on their phone or computer, leading to live data on how the campaign is going.

It will be easier too to link in other communication tactics such as phone banking or peer-to-peer SMS – learning from the expertise PCS have built up in recent industrial action ballots. The union can also provide standard letters for members to send to their employer as part of the process, so all they have to do is sign it and they’ll get removed from check off and started on direct debit.

Designing your own process

Sam Jeffers of online join co-op JoinTogether outlined some principles of how an effective switching service should work.

Targeted

As we’ve seen over the last year with ballot campaigns, good data leads to good results. The union needs to know who the affected members are, where they are located in which workplaces, and how you can contact them across all the channels you’ll need.

That can be an issue with check off members in some unions, where you haven’t necessarily had such regular updates on individual contact data in your central database.

Having confidence in the quality of your data will help you start to know how much effort you need to put in to do the groundwork to set a switching campaign up.

Convenient

The union needs to do the hard work to make it easy for the member.

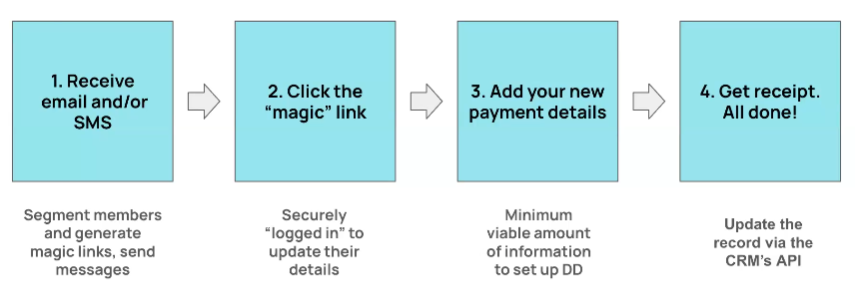

People should be able to self-serve, and follow as few steps as possible. If you give people a set of instructions to follow, very few will start it, let alone complete. It’s much more effective to lead them through it in an intuitive way – receiving a communication, clicking a link, and being able to complete the process on their phone with minimal calls for extra information, in a minute or two at most.

This is how the majority of your members are likely to switch, which leaves you with as small as possible a set of members needing more intensive routes like phone banking or a visit in the workplace.

This is doubly so for younger members, who are less likely than ever to answer the phone to a number they don’t know. Finding the contact point that gets their attention is important – SMS will often do many times better than email, which itself works better than phone calls.

Ideally your service just has to work the same way as other things your members are used to, such as completing tasks in online banking or changing account terms with their energy supplier. People are often doing tasks like this on their mobile phone, with other things competing for their attention at the time. If they come across even a small hiccup on the route, they may end up deciding they’ll come back to it later, and that might be a long time – if they do remember to.

Connected

It’s great if you can find a way to avoid making members log in or remember credentials that they don’t use often. Many members will never have logged in to the union’s portal to change their details before, and either aren’t set up for it or have forgotten the login details they were allocated.

If you can log members in automatically from the communication they receive, then they can just add their payment details. Then they get a receipt to acknowledge that the change has happened.

And in the background the CRM is updated by the API, so the union knows what’s going on in real time. That can be really important in helping avoid confused communications. Ideally you never want to be sending anything that says “if you’ve done this already, ignore this message”, which could irritate those who have switched and confuse those who haven’t.

Another benefit of linking into the CRM is that you can display information you currently hold, and give members the opportunity to verify it, or change it if it’s wrong.

Secure

Unions need to know that the person updating the record is actually the member and that no one else can see those details.

So it’s really important that you’re not just creating open web forms, where people can throw in all sorts of information that might be wrong, or weak verification processes where it becomes too easy to access member details and anyone with a very simple piece of information could find out who your members are, which would be a major data breach if it happened.

On the other hand you have traditional member portals. Often these are filled with a wide range of tasks that members can complete. This can make them hard to navigate when there’s only one task at hand, especially if you don’t log into them often, as is the case for most members. They’re secure but can be clunky, and that reduces the number of people who will successfully complete the task.

Magic links can be a way of working around this. You’ve probably come across them if you use services like Slack. As long as you have access to your email address, you can request a magic link from the service to log in, which is emailed to you, and the link in it takes you straight to the task you need to complete, without the need for a password. The link has the needed security built into it. It’s an encrypted piece of information, secure and unique to you and acts as the identifier that logs you into the system.

The form people will need to complete also needs to be ‘magic’. Every optimisation you make will mean a higher proportion of people completing it first time, and less work chasing up through more labour-intensive means.

Once members are logged in, you can play a little of their information back to them to give them confidence, and then they can update their payment details, with as few barriers in their way as possible.

The bare minimum is their bank account: account number, sort code, and name. Everything else you know already. They just need to confirm they can set up Direct Debits, and they’re done. It could be as little as two screens and a receipt to confirm they made the change (an important confidence building step).

Don’t do too much at once

There’s a judgment call you’ll have to make about how much you want to do in this process. For example do you want to check that their address is correct, or that their salary might have changed, so they’re paying the right subs band?

This can be really powerful, but it is generally best to err on the side of caution in adding more steps to the process. You may get better results on the main task (signing up direct debits) if it has fewer distractions.

There may also be other opportunities for gathering this data using a similar system later in the year. One of the challenges in moving from check off to direct debit is that you don’t automatically know members’ salary increases any more, so you may find members stay on lower subs bands than they should be.

Planning the system

One way to make your switching service better fit members’ needs and expectations is to draw up a ‘service map’ for the campaign.

To do this, spell out the steps in the process, from first interaction to completion. Breaking it down chronologically helps you understand what the user might expect to happen at each step. Then work out what are the different things that need to happen to meet that expectation. What is the member doing? What is the union doing behind the scenes? What data needs to be pulled out of systems, changed, and put back in again? What communication is needed? What help or support might members need?

People will have different potential journeys through this, which could get complicated. A large proportion of people aren’t going to complete this on the first pass, so you might have to approach them through other digital channels. Or your reps and organisers might need to go and see them in the workplace, or follow up by post.

But if your system is linked to your CRM, you can run it as a circular loop, where the number of people is gradually getting smaller and smaller with each intervention.

User research and testing will also pay off. Get some members to try anything you make before it goes live and get their thoughts on it. Can they complete this process once they get these links? What are they thinking as they do it? Where are any potential barriers? This can throw up problems you didn’t anticipate.

Things to consider

Here are a few ideas and concerns that arose from a discussion between unions considering running switching campaigns

Security concerns

Some members will naturally have concerns at any kind of interaction that asks for their bank account details. They are particularly attuned to phishing scams because we’re all so used to getting those through almost every communications channel. Making sure that your switching tool is union branded, with a domain that reflects the union, and that your people can answer any questions will be really important.

Cancelling check off

The member themselves need to tell their employer to cancel the check off arrangement (the union can’t do this on their behalf). But you can make this easier for them as part of the process, by providing templates or email tools for it.

Another way is to agree with the employer when the last check off date will be, and cancel the whole arrangement. That way you can gather details but tell members the first DD payment will only be after a certain date. However to do this, you need to be sure you can complete the campaign in time, as you are placing a hard deadline on membership.

Direct debit dates

Check off is often popular with members as it comes out on payday, when members know they’ll have the money. Moving to a regular date in the month may not line up with that date for all members. Some unions give members a choice of direct debit date, but this increases the administration overhead on the union.

There is also potentially an issue with weekly paid workers, for whom a 4 week pay packet will be out of sync with a monthly direct debit. Offering 4 weekly membership as well as monthly can be confusing in terms of the different rates that members will see. Research with members will help you understand if this is going to be a problem for any of them that might reduce the number who switch.

Checking data before your campaign

Any work you can do to check all contact points you may need to use in the campaign before it starts will pay off in the number of members switching.

If members have paid through their employer for years, and had little to do with the union’s own systems, their details could potentially be very out of date, and might have wrong (or even missing) information like email addresses or mobile numbers.

It’s cheap and easy to run a checking campaign to use SMS to verify email addresses or vice versa (see this case study).

Another way to get a sense of how accurate your data is, could be to use a commercial data cleaner. These firms check an upload of your member data and verify if the email addresses, mobile phone numbers and landlines are still active? They’ll also check whether your member has been marked as having moved house (and in some cases can return an address from the Royal Mail redirection service). In a recent pilot we found that checking all four data points in this way cost around 16p per record (with the majority of that cost being related to the address field). The results from this could help you identify where you might have greater problems in different parts of the union, and prioritise organising resources appropriately.

Otherwise you will likely need to develop a mechanism for reps and activists to see members who have not yet responded, and update their information after a conversation in the workplace.

Justifying the spend you need

Developing your own tools for this, and allocating the staff time to an intensive campaign, can be expensive for unions. You may need to make a case for the budget within your union.

To do this, look at what might happen if you fail to switch all your members. If you end up losing 10% or 20% of members, that can be translated into a monetary sum by looking at their average subs rates, and their average tenure in membership.

If you’re considering 1,000 members failing to complete, when they pay £150 a year, and staying in membership an average of 5 years, that could be £750,000 in lost income to the union.

Involving activists in switching campaigns as a stepping stone to deeper involvement

Distributed communications methods such as peer-to-peer SMS can be really helpful to a switching campaign. If you can put data, messaging and tools in the hands of activists, they will be able to talk to their colleagues, either online using their personal connection, or directly in the workplace.

And getting involved in a defined campaign like this can be a good way for members to get active in the union, where they might have held back in the past because they didn’t want to take on the full role of reps. They know they’re only going to have the short-term responsibility they’re signing up for, but it might give them the bug to do more if they enjoy it.

Alternatives to direct debit

PayPal is a possible alternative to direct debit, using their subscription model. There are big downsides to this. The costs are very high in comparison to direct debit, and you can’t automatically update the subs rate over time. But it can be a way to collect subscriptions from people who don’t have a UK bank account. For workers at British employers in other countries, who have foreign bank accounts, it could also be a way to deal with different exchange rates.

What next?

If your union is planning a switching campaign and you would like to talk through any of this, please do get in touch. Also let us know if you think there is anything by way of trainings, case studies or tools that the TUC Digital Lab could help provide.

If you don’t yet have a tool ready to run your switching campaign, you might want to consider contacting Join Together to use their Software-as-a-Service product. Their system was originally designed for handling annual membership renewals, works well in a switching context too. It currently integrates with APT Stratum or Microsoft Dynamics databases and could connect to other common platforms.