At Equity, we’ve started a programme to use the Net Promoter Score measurement in our member engagement work. It should help us understand better how members are feeling about their union, and also give us tangible pointers for where we can improve their experience with us.

Net Promoter Score (NPS) is a concept that was invented by the management consultant company Bain, and it’s been pretty widely adopted over the last decade or so.

It’s a question you will probably have seen everywhere in your interactions with companies and organisations. I’ve seen it this week on car insurance renewal forms, Pizza Express surveys and Apple customer emails. It’s the question that asks you how likely you are to recommend this service, product or event to a friend or a colleague?

It works on an index ranging from -100 to +100, which is derived by asking a group of people to make a rating on a 0-10 scale, and aggregating the results. Quite often it comes with a follow-up question to the score question. Something like “What’s the reason that you gave us this score?”, “What improvements would you suggest?”, “Any other suggestions?”, or “What do you like or dislike?”

How it’s calculated

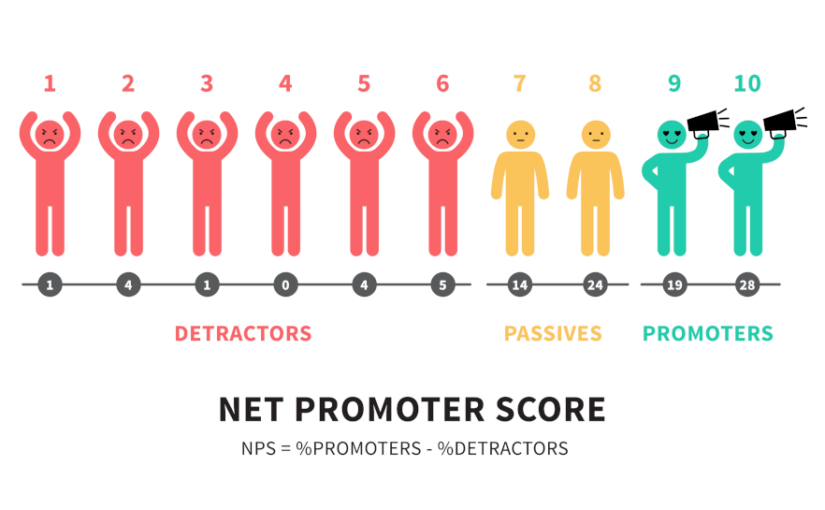

The answers for the first question get tallied up. Everyone who scores 0-6 are known as “detractors”. These are members that are probably going to spread at least slightly negative word-of-mouth about your union to other members and prospective members.

Your 7s and 8s, sit in between and could go either way, depending on a good or a bad experience. They’re known as “passives”.

And then you have your “promoters”, who scored 9 or 10. They’re going to love the union and be ambassadors for you, staying positive even if you make occasional mistakes.

To work out your Net Promoter Score, you take the percentage of respondents who were promoters, and subtract the percentage who were detractors. So if you had a group of 100 members, with 50% as promoters, 10% passives, and 30% detractors, you’d end up with an NPS score of +20.

I personally feel like the score is a bit of a temperature check because it can be quite easily swung either way, and it can change if you make small changes to the way of gathering it. For example, I’ve found whether you put it at the start of a survey or at the bottom of a survey can even slightly change how people score you, depending on the context in which they see the question.

I always also look at the passives. As these are the people who could go either way, I think they’re the group of people that you should most concentrate on giving a good member experience to. That’s not to say you shouldn’t provide a good experience to everyone, just that the promoters are already happy, and the detractors possibly have made up their mind, so it’s going to take a lot of work to make them happy. Whereas the passives could be moved into being great advocates for membership, and really useful in recruiting more members to the union.

Where can you use it?

You can use the question as part of a bigger survey, or on its own in a process that people are completing online.

It’s a good idea to ask the question in every annual survey, getting to the widest group possible.

But it’s also useful in smaller groups. You can also use it exit surveys, where members leave you. Or for annual memberships, you can set it in automated journeys, so that new joiners get asked six months through their first year – that gives you time to analyse and rectify anything that might be a problem before they start thinking about renewing membership.

It’s also helpful to do in small samples of the general membership. For example, a monthly batch of about 2000 members will let you do a regular temperature check with a decent sample size, without needing to bother any one member too often.

With that approach, you can even add in a few topical questions to make a mini survey for other ideas that different parts of the union need to test out.

The NPS score that each member gives gets merged into the overall union score, but it’s also useful to incorporate back into the member’s CRM record, so you can see where a particular member sits if you need to work with them.

Analysing the data

Once you have the score in your database, you can analyse it by any cohort you like. That might be industry, location, personal characteristics, or different engagement opportunities.

We use it alongside other metrics like our click through rates on newsletters, our website usage. It is really important to say that NPS is just one measure and it should be looked at with all of that other data in context, so that you have that full view of what’s going on.

The follow-up question is also really key. By getting a team of people to look through responses, you can fairly quickly tag the answers that people give into similar categories. That way you can come up with lists of main concerns members have, the degree to which they are held in your membership, and an indication of how severely they may be impacting member experience.

You also have the opportunity to go back and close the loop on issues where you are able to try something new – telling members that you’re addressing their concern. That could be on a group level to inform them of changes they will be receptive to. Or it could be on a personal level to deal with a problem that may be affecting that member’s scoring. Sometimes I’ve found that members presume something doesn’t exist, when it is actually available to them, they just don’t know about it. A follow up call could make a big difference to their satisfaction with the union.

Using the two in combination, you can see which issues are affecting particular groups, such as your passive members. You can also verify whether changes you make against a particular issue are actually working in improving your members’ experience and their feelings about the union.

NPS and the union

I’ve been at Equity for about two years now, and I came to the union from another membership organisation that used to make very heavy use of NPS. So initially I did a trial piece of research to see if it would work here too, and I was really pleased to see from the results that we already had a great score with members.

But there was a bit of resistance internally to the new approach, as it’s seen as being quite a corporate-style measure, which might jar with attitudes to how a trade union should operate.

And there’s a degree of truth in that. The union isn’t as directly concerned about measuring costs and customers as a company would be – we’re more concerned with our collective mission than individual service. We can’t directly pick up what companies are doing and expect it to deliver the same use here.

But there is a lot of use we could be getting from it, if we are using it appropriately to a union context.

In an industrial context, we can segment members to get a better picture of engagement and concerns within a particular target industry or area. This can be really helpful in formulating organising strategies where we need to grow.

A standard format like NPS also lets us benchmark ourselves against other unions and organisations that use it. Sharing between unions on the learning here could be helpful to the whole movement.

And without doing this kind of work, we run the risk of entrenching existing misunderstandings between members and the union. For example in looking through our detractors, we found a number of people were scoring Equity poorly because they didn’t think we were doing well enough on things that we don’t actually do, such as finding work for them. The members had misplaced expectations from us, which has implications for how we recruit.

I’ve been working on a membership plan, which is very much tied to the organisation’s vision. We want to use NPS and other membership data techniques to help underpin the union’s needs for data to improve all our strategies.

Next steps

The work we’ve done at Equity has been a bit improvised so far, using Excel to analyse results. That’s been fine as we experiment and find out how this will be useful to the union, but we’d like to improve things as we get further into this. We’re interested in using better analysis and visualisation tools, like PowerBI, to draw out connections more easily in our reporting.

We’re also hoping to have this better integrated with CRM in the future. That could cut down on processing time, but it would crucially mean that we can include NPS score and key issue comments on members’ profile information. That way, when a membership officer speaks to a member, they’ll have the information at their finger tips. If the member is a detractor, they would be able to see a reason why this is, and address that as part of the call.

Sam Fletcher is Head of Membership at Equity